More About Short Term Loan

Wiki Article

What Does Short Term Loan Do?

Table of ContentsHow Short Term Loan can Save You Time, Stress, and Money.An Unbiased View of Short Term LoanHow Short Term Loan can Save You Time, Stress, and Money.Examine This Report on Short Term LoanA Biased View of Short Term LoanNot known Factual Statements About Short Term Loan

What are short-term lendings? Short-term loans are unsafe individual fundings.

They are easy Getting a temporary car loan online is typically really basic, You will certainly be asked to supply some basic individual info, as well as proof of your economic condition. Lenders will desire to understand whether you are employed and also just how much your income is. They may additionally request for your address details and can inspect your credit rating, which will allow them to learn whether you have actually had trouble paying back debts prior to.

More About Short Term Loan

Otherwise, the basic online application is usually all you require to complete prior to the cash is in your financial institution. There is lots of options Gone are the days when all of us required to rely on our high street financial institution to give us with fundings. Loaning online has ended up being the standard and also consumers are progressively certain dealing with on the internet economic solutions companies that typically supply much more versatile terms and much better prices than conventional financial institutions.This is due to the fact that they can keep financing values little and also rate of interest prices are commonly quite high in order to minimize the risks involved. Some lending institutions will consider offering to consumers with poor debt rankings offering they can show they have a regular revenue in order to repay the lending. They are highly controlled Offering you obtain with a lending institution authorized and registered with the Financial Conduct Authority (FCA), they are bound by accountable loaning needs.

Drawbacks of short-term fundings Higher rate of interest rates Because unprotected temporary car loans bring better threats for lending institutions, in regards to the likelihood that borrowers will certainly fail, rate of interest rates can be higher than for a few other kinds of loan. When choosing which temporary finance service provider to select, it's a good idea to examine the Complete Quantity Repayable (TAR) number, as well as the rates of interest charged.

The Ultimate Guide To Short Term Loan

In spite of the opportunity of additional charges, FCA regulations currently secure consumers from accumulating a debt spiral by covering complete rate of interest billed on temporary financings. At the height of the payday financings click resources detraction, some borrowers discovered that their rate of interest and also charge were mounting up quicker than they can maintain, particularly if they missed out on a payment at any type of factor.You may also boost your credit history score while doing so.

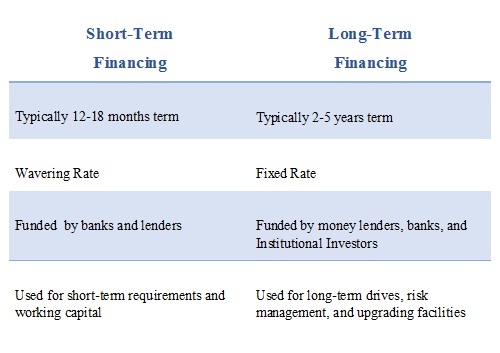

Temporary financing is a method to get cash fast based off your credit history, economic situation, and history with a lender. There are pros as well as cons to temporary financing, with benefits as well as negative aspects depending upon why you're obtaining it as well as what you're finishing with it. A sound financial strategy goes a lengthy method in optimizing one's short-term financing.

The Main Principles Of Short Term Loan

Here are is a fast look on different benefits as well as disadvantages of brief term financing: There are many benefits as well as disadvantages of brief term financing. The one benefit that evaluates one of the most is the convenience of applying. A discover here temporary financing is generally for a smaller sized amount of cash than long-lasting financings are.This indicates you can find out faster whether you qualify or not as well as do not necessarily have additional hints to wait extremely long to access the funds, either. Some lending institutions of short-term funding does not count on credit report rankings so much as proof the lending's able to be paid off.

You need to pay on temporary funding fast as well as continually. There is no 'missed out on payments' on short-term fundings. This increases the pressure on you to make certain those settlements happen and that they are on-time. If there are not, you can incur charges as well as charges that can paralyze your economic situation.

The Single Strategy To Use For Short Term Loan

This usually implies full settlement in under a year. This comforts a lending institution they can provide you a loan and also are going to obtain it back quicker than lasting funding. This works in your benefit as it does theirs, securing funding for you swiftly. More individuals get approved for short-term fundings.Relatively, a longer term can guarantee you a lower interest price. For some, this means paying a lot more due to the much shorter term. If you have high-interest debts that need to be dealt with immediately, you may locate short-term funding to be of help. Though going right into debt to leave financial debt seems counter-intuitive, thinking there's a method to pay this loan back.

A Biased View of Short Term Loan

For that, short-term financing is better. Some monetary organizations and also lenders use an 'early payment price cut'. If you make your payments on-time or are paying down your financing faster than anticipated, you may qualify for a decreased rate of interest rate. This isn't always the case, nevertheless. Do check the terms beforehand.If you're arranged as well as remain on top of the repayment schedule, there should not be any kind of difficulty bringing your funding to a final thought. Short term loan. Some sadly aren't so organized and also can handle more financial debt that they can swiftly. By not viewing where things are heading, one can really swiftly wind up in an opening.

Report this wiki page